What It Reveals About Mindset, Brand, and Focus Behind Cybersecurity Startups Built by Indians

Key Takeaways

- Wiz’s $32B valuation shows how clarity, focus, and storytelling create compounding value.

- Indian founders build with discipline, but often undervalue brand and narrative.

- Building more features rarely beats building a sharper story.

- Cybersecurity complexity rewards clarity, not comprehensiveness.

- Trust and valuation grow faster when companies brand as they build.

In March 2025, Google agreed to acquire Wiz, the cloud-security startup founded in Israel and headquartered in the U.S., in a deal reportedly valued at about US $32 billion, pending regulatory review. Wiz’s reported $32 billion acquisition makes it worth roughly as much as the entire Indian cybersecurity startup ecosystem combined, although no official aggregate valuation exists. Industry estimates suggest Indian cybersecurity companies collectively fall between US $20–40 billion based on funding and reported valuations. This estimate is based on India’s ~$10 billion cybersecurity market size (IMARC, 2024) and typical early-stage SaaS valuation multiples of 3–5× revenue.

At first glance, it looks like a story about timing and capital.

Look deeper, and it becomes a story about mindset, market, and brand.

Two Worlds, Two Operating Systems

India has world-class cybersecurity talent. India contributes a significant portion of the global cybersecurity workforce, though reliable public estimates vary. Reports from Nasscom and ISC² suggest India ranks among the top three talent hubs globally.

The gap is not capability. It is conditioning.

| India’s Constraint Mindset | The West’s Abundance Mindset |

|---|---|

| Build realistically with limited resources | Build ambitiously assuming future resources will come |

| Prove profit early, then raise | Raise early, then prove growth |

| Valuation follows traction | Valuation often precedes traction |

| Engineering first | Narrative first |

| Frugality as a virtue | Visibility as a growth driver |

| Build quietly | Build loudly |

Indian founders are trained to build from scarcity.

Western founders are trained to build from possibility.

And in markets where attention drives capital, possibility wins.

Indian Cybersecurity Startups and Their Estimated Valuations (2023–2025)

While Indian cybersecurity talent runs deep, company valuations tell a different story. According to IMARC data reported by Entrepreneur.com, India’s cybersecurity market was valued at approximately US $9.8 billion in 2024, with forecasts projecting steady growth.

The table below highlights some of India’s leading cybersecurity startups and their latest funding or valuation data, a reflection of how underpriced the ecosystem remains compared to global peers.

| Company | Approx. Valuation / Latest Funding | Notes & Sources |

|---|---|---|

| Zyber 365 | ~US $1.2 billion | Raised US $100 m from SRAM & MRAM Group (July 2023). Economic Times |

| CloudSEK | ~US $118 million | Valuation after US $19 m fundraise (2025). NewsDrum |

| Safe Security | Raised US $70 m, total funds ~ US $170 m | Focuses on risk quantification and autonomous cybersecurity. Times of India |

| WiJungle | ~US $22 million | Unified network security platform; valuation reported by Republic Business. Republic Business |

| Securden | Raised US $10.5 m Series A (2022) | Privileged access management platform. Republic Business |

| Sequretek | Raised US $8 m Series A (2023) | Backed by Omidyar Network. Indian Startup Times |

| Innefu Labs | Valuation not public; raised ~ US $2 m (2017) | AI-driven predictive security and analytics. Wikipedia |

| Seconize | Early stage; funding not disclosed | Risk and compliance automation startup. Republic Business |

| PingSafe | Acquired by SentinelOne for > US $100 million (2024) | Cloud-native security platform by ethical hacker Anand Prakash. Wikipedia |

| TAC Infosec | Public company; valuation not published | Listed cybersecurity services firm backed by Vijay Kedia. Economic Times |

| Deep Algorithm Solutions | Raised ~ ₹10.8 crore (US $1.3 m) seed (2025) | AI-driven data security platform. Economic Times |

| Treacle | Raised ₹4 crore (~ US $0.48 m) pre-seed (2024) | Building data-centric cybersecurity infrastructure. Entrackr |

| Lucideus (now Safe Security) | Previously valued ~ US $300 m (before rebrand) | Legacy valuation before merging into Safe Security. Inc42 |

| CyberPeace Foundation | Nonprofit with strategic cybersecurity initiatives | Focused on training and research, not valued commercially. Economic Times |

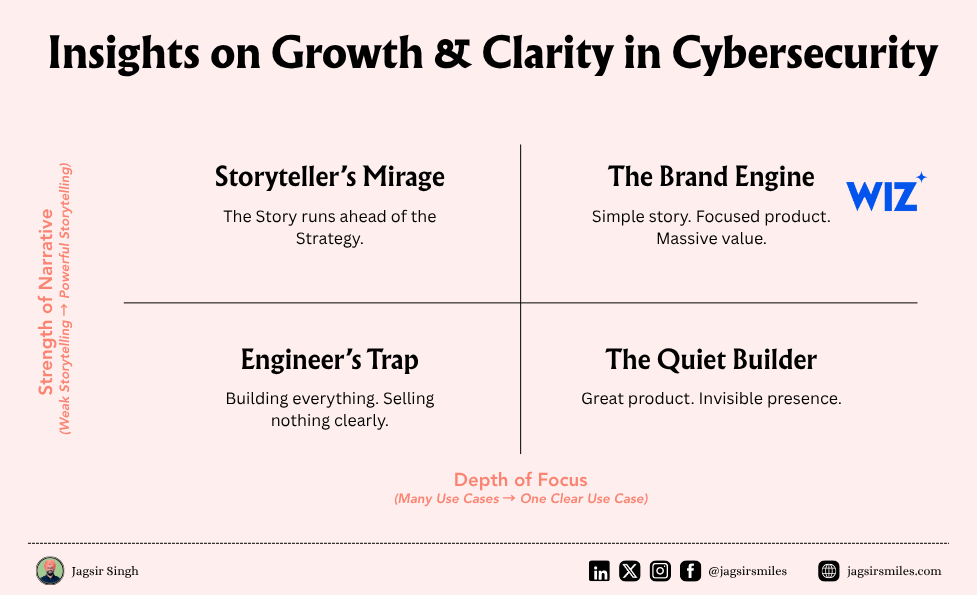

Brand as a Force Multiplier

Wiz did not just build a product. It built belief.

It positioned itself clearly as cloud security for the cloud era. Every investor, analyst, and CIO knew what Wiz stood for.

Most Indian cybersecurity firms, on the other hand, are laser-focused on engineering excellence but not on brand building. They focus on what they are building, not how it is perceived.

That works in engineering. It fails in markets.

Because valuation is not only a measure of capability. It is a measure of credibility.

Western founders understand this. They invest early in design, messaging, PR, storytelling, and thought leadership.

They build the brand as they build the business.

Indian founders often wait until they are “big enough” to brand. By then, the market has already been shaped by louder players.

In cybersecurity, brand equals trust, and trust compounds faster than revenue.

The Cost of Opportunity in Cybersecurity

Cybersecurity is one of the most crowded and competitive industries in enterprise technology.

Every company says it is AI-driven, zero trust, or cloud-native. Every deck looks the same.

When differentiation fades, the cost of opportunity rises. It becomes harder and more expensive to earn a CISO’s attention.

This is where many Indian cybersecurity companies lose ground.

Coming from service-driven roots, they believe doing more wins trust: more features, more modules, more use cases.

But in reality, doing more often means saying less.

The more you try to do, the weaker your story becomes.

Western companies handle this differently. They start narrow and go deep. They pick one or two high-value use cases, craft a bold story around them, and dominate that niche before expanding.

That focus gives them pricing power, investor confidence, and brand clarity.

Indian companies, by contrast, underprice themselves while overbuilding. They compensate for weaker storytelling with more features, not realizing that clarity sells better than complexity.

Pricing is not just a financial lever. It is a storytelling lever.

When you price higher, you tell the market, “We solve a deeper problem.”

When you price lower, you tell the market, “We are one of many.”

The result: the cost of opportunity keeps increasing, not because the market is unfair, but because the message isn’t sharp.

The Complexity Trap

Cybersecurity itself is complicated.

Every CISO faces hundreds of problems: identity management, data protection, threat detection, compliance, endpoint security, OT protection, and more.

No CISO expects a single vendor to solve everything. They expect vendors to solve something specific, exceptionally well.

Yet many Indian founders fall into the complexity trap.

They believe that to win customers, they must build everything.

“If the customer has ten problems, we’ll build ten solutions.”

That instinct, born of a service mindset, backfires in product-led businesses.

Cybersecurity does not reward comprehensiveness. It rewards clarity.

Western founders understand this. They pick one hard problem and solve it better than anyone else.

When you try to do everything, two things happen:

- Your story gets diluted.

- Your go-to-market becomes heavy and slow.

CISOs do not want universal vendors. They want focused partners who take one hard problem off their plate.

Winning in cybersecurity is not about doing more. It is about doing less with more conviction.

That is why companies like Wiz, Netskope, and CrowdStrike grew quickly. They simplified the problem before they solved it.

The Role of the Ecosystem

Another difference lies in ecosystem readiness.

In the U.S. and Israel, analyst firms, venture networks, and partnerships accelerate early-stage visibility. Gartner, Forrester, and IDC track new entrants within two years of launch.

In India, many startups enter those circles too late. They wait until they are “ready.” By then, the category has already been defined by someone else.

Brand ecosystems work like network effects. If you do not show up early, you get indexed late.

The Perception Problem: When Indian CISOs Don’t Bet on Indian Startups

There’s another layer to the valuation gap, how the market perceives Indian cybersecurity startups.

Even inside India, many CISOs don’t trust Indian-born products yet.

It’s not about capability. It’s about perception of maturity.

Most enterprise CISOs want to see validation from outside India, a U.S., European, or Southeast Asian footprint, before they sign a cheque.

In boardrooms, “proven globally” still outweighs “built locally.”

That creates a loop that slows Indian cybersecurity companies down.

Startups struggle to sell at home, so they chase pilots abroad.

Without visible wins in India, they appear even less credible domestically.

Meanwhile, Indian buyers lean toward Western vendors because they look safer, backed by bigger names, bigger funds, and better marketing stories.

It’s not that Indian startups lack capability.

It’s that they communicate defensively.

They’re cautious about fundraising. Diplomatic in messaging. Conservative about their achievements.

In cybersecurity, that restraint reads as uncertainty.

Contrast that with U.S. or Israeli startups, which lead with conviction. They declare category leadership from day one, amplify investor logos, and use every pilot as a story of validation.

Until Indian cybersecurity founders own their narrative, not just their technology, this perception gap will continue.

Because in cybersecurity, trust is often built long before the first product demo.

A Tale of Two Outcomes

Wiz became the world’s most valuable cybersecurity startup not just because it had a great product, but because it had focus, clarity, and narrative discipline.

It solved one big problem, securing multi-cloud environments, and repeated that message everywhere.

Google did not just buy Wiz’s technology. It bought its clarity.

Indian companies, on the other hand, often dilute their own story by trying to serve everyone. Their technology is strong, but their go-to-market story gets lost in translation.

Indian-origin founders who operate in Western ecosystems — like Jay Chaudhry (Zscaler), Nikesh Arora (Palo Alto Networks), Sanjay Beri (Netskope), and Jaspreet Singh (Druva) — succeed because they combine India’s technical depth with the West’s storytelling fluency.

| Indian-Origin Global CEOs | Approx. Net Worth |

|---|---|

| Jay Chaudhry, Zscaler | $17.9 billion |

| Nikesh Arora, Palo Alto Networks | $1.5 billion |

| Sanjay Beri, Netskope | ~$400 million (est.) |

| Jaspreet Singh, Druva | ~$200 million (est.) |

When they moved into ecosystems that reward narrative as much as product, they unlocked massive value.

They did not change what they built. They changed how they told it.

Data on valuations across Indian cybersecurity startups is fragmented, but even the most optimistic estimates place the ecosystem’s combined worth at a fraction of Wiz’s $32 billion deal. That gap highlights not just capital disparity, but a difference in storytelling, focus, and market positioning.”

The Investor Psychology Gap

Western investors price potential.

Indian investors price performance.

In Silicon Valley, the story precedes the spreadsheet.

In India, the spreadsheet precedes the story.

That difference shapes valuation velocity.

Wiz’s $32 billion outcome is a clear example of what happens when capital believes in what can be.

Indian companies often wait to show what already is.

The Lesson

The story of Wiz is not just about timing or technology. It is about how clarity of story defines scale of outcome.

Indian founders do not need to abandon their discipline or engineering-first culture.

They need to pair it with storytelling, invest in brand early, simplify their message, and focus on fewer, higher-impact use cases.

India has built the baseline technology that powers much of the global cybersecurity industry. The greater responsibility now is to learn how to earn the true value of what we build.

In cybersecurity, trust is the currency.

And trust grows fastest where clarity lives.

When Indian founders learn to build brand as deliberately as they build product, the next multi-billion-dollar cybersecurity company could very well come from India.

Questions Worth Debating

- Should Indian founders treat branding as a growth engine, not a luxury?

- Does focus beat comprehensiveness in winning enterprise trust?

- Are Western valuations inflated, or are Indian valuations under-appreciated?

- Should investors price potential, not just performance?

- What happens when Indian founders master both precision and presence?

Have thoughts or want to contribute to this article? Reach out through the contact form: https://jagsirsmiles.com/contact

References

- Gartner and Forrester Market Reports on Cybersecurity Trends (2023–2024)

- Google Official Blog: Google Agreement to Acquire Wiz (March 2025)

- Wiz Inc. Company Overview, Wikipedia. Reuters: Google’s $32 billion Wiz deal faces review. Financial Times: Alphabet agrees to buy Wiz for $32 billion

- Zyber 365 has publicly claimed a $100 million round at a $1.2 billion valuation, according to media reports. However, those numbers have been questioned in some investor circles and remain unverified by independent filings. Economic Times: Zyber 365 funding announcement

- PingSafe was acquired by SentinelOne in early 2024. Media reports placed the deal value above $100 million, while SentinelOne’s filings break the total consideration into cash and stock components. SentinelOne Press Release / 10-K: PingSafe acquisition.

- CloudSEK reported a post-money valuation of roughly ₹1,000 crore (≈ US $118 million) following its 2025 funding round, as per Business Standard and PTI reports. Business Standard / PTI: CloudSEK valuation and funding.

- Safe Security (formerly Lucideus) raised a $70 million Series C, bringing its total capital raised to about $170 million. Times of India: Safe Security $70 million Series C.

- Zscaler and Jay Chaudhry Company Reports (2024)

- Forbes: The World’s Billionaires 2024 – Jay Chaudhry, Nikesh Arora

- Indian cybersecurity market value: US $9.8 billion (IMARC data) in 2024. Entrepreneur

- Indian cybersecurity market value: US $10.85 billion in 2024. Claight

- Expert Market Research: India cybersecurity market forecast to $31 billion by 2034